Overview of Half Year Financial Reports for Construction Machinery: 19 Domestic Companies with Net Profit Growth and 4 Companies with Losses

According to the recently released 2023 semi annual report data, 19 out of 26 listed construction machinery companies in China have seen an increase in net profit (note: unless otherwise specified,

all refer to net profit attributable to the parent company), 3 have decreased net profit, and 4 have suffered losses. Weichai Power and XCMG Machinery are the two companies with the highest net profits,

with 3.899 billion yuan and 3.589 billion yuan respectively. Construction machinery is the company with the highest losses, with a loss of -224 million yuan.

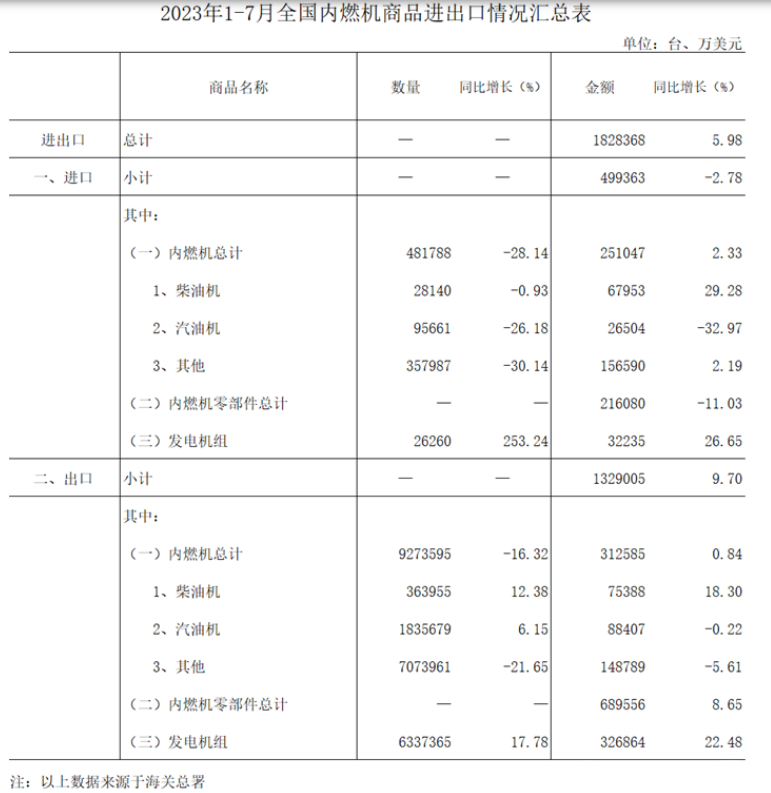

According to data released by the General Administration of Customs, the total import and export volume of the internal combustion engine industry from January to July was 18.284 billion US dollars

According to data compiled by the General Administration of Customs, the total import and export volume of the internal combustion engine industry from January to July 2023 was 18.284 billion US dollars,

a year-on-year increase of 5.98%. Among them, imports were 4.994 billion US dollars, a year-on-year increase of -2.78%, and exports were 13.29 billion US dollars, a year-on-year increase of 9.70%. In terms of

export value, except for gasoline engines and other types of complete machines, all other sub categories showed year-on-year growth.

A historic leap in globalization! Sany Heavy Industry Releases the 2023 Half Year Report!

On August 30th, Sany Heavy Industry announced its 2023 semi annual report. During the reporting period, the company achieved a revenue of 39.496 billion yuan, a year-on-year decrease of 0.38%;

The net profit attributable to shareholders of the listed company was 3.4 billion yuan, a year-on-year increase of 29.07%; The net cash flow generated from operating activities is 402 million yuan.

It is worth mentioning that during the reporting period, international revenue accounted for 56.88% of operating revenue, and the majority of the company's revenue and profits came from the

international market, achieving a historic leap. With the changes in the composition of global business, the company's "internationalization" strategy has been upgraded to a "globalization" strategy.

XCMG Machinery's net profit in the first half of the year exceeded 3.5 billion yuan, a year-on-year decrease of 2.1%, and its exports reached a new high

On August 30th, XCMG Construction Machinery Co., Ltd. (XCMG, 000425) announced that in the first half of this year, the company achieved a revenue of 51.278 billion yuan, a year-on-year decrease of

4.78%; The net profit was 3.589 billion yuan, a year-on-year decrease of 2.1%. During the reporting period, XCMG Machinery achieved a domestic revenue of 30.3 billion yuan, a year-on-year decrease of

20.46%; Overseas revenue reached 20.9 billion yuan, a year-on-year increase of 33.49%, and its proportion in total revenue increased from 29.07% in the same period last year to 40.75%, reaching a new high.

Zoomlion Heavy Industries released half a year's results, with a revenue of 24.075 billion yuan

On the evening of August 30th, Zoomlion Heavy Industries released its semi annual performance report for 2023. The report shows that during the period, the company achieved operating revenue of 24.075

billion yuan, a year-on-year increase of 13.03%, including overseas revenue of 8.372 billion yuan, a year-on-year increase of 115.39%; The net profit attributable to the parent company was 2.04 billion yuan,

a year-on-year increase of 18.90%; The net profit attributable to the parent company after deducting non recurring gains and losses was 1.688 billion yuan, a year-on-year increase of 40.31%.